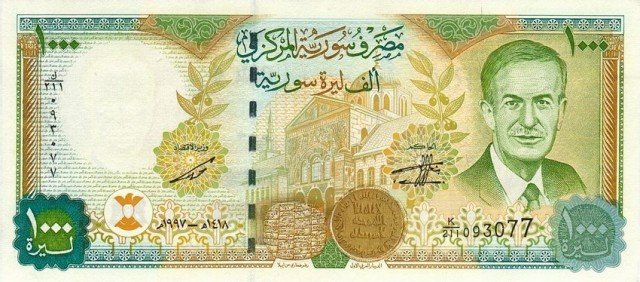

One reason Assad will lose the war is due to a crumbling Syrian Lira.

Syrian state media says the central bank is pumping up to $200 million into the market to help boost the sagging Syrian Lira.

Three government newspapers — Baath, Thawra and Tishrin — carry reports Monday about the plan.

The Syrian pound has plummeted against the dollar, spiking at 318 Liras to the dollar compared to 150 Liras three months ago.

Syria’s central bank started selling tens of millions of dollars over the weekend as part of its plan to inject up to $200 million to try to stabilize the Lira.

The official exchange rate is set at 260 Liras. The Syrian currency was trading at 292 to the dollar on the black market Monday.

Central bank governor Adib Mayyaleh urged Syrians not to trade on the black market.

One reason Assad will lose the war is due to the fact that all salaries the Assad forces are paid with come in local currency. Many have not been able to sustain their families on their measly income when imports of goods are paid for with foreign currencies.

This has led many of Assad’s soldiers to defect to the other side where the rebels are paid in U.S. Dollars courtesy of Saudi Arabia, Qatar, and Turkey.

The New York Times, in an article entitled “An Eroding Syrian Army Points to Strain“, described the Hezbollah-Syrian army rift:

“Then there is simple jealousy. Hezbollah fighters are paid in dollars, while Syrian soldiers get depreciating Syrian pounds. Hezbollah fighters get new black cars and meat with rice, Ali said, while Syrian soldiers make do with dented Russian trucks and stale bread.”

To a Sunni fighting for Assad, this preferential treatment smacks of sectarianism. No wonder defections to the rebels keep mounting.

One reason Assad will lose this war is because of the crumbling Syrian Lira now worth almost 2.5 times less than 3 months ago.

Is he printing too many Syrian Liras while at the same time pilfering the foreign currency he gets from Iran? This inflationary decline in the Syrian Lira value indicates he may be.

AP contributed to this article.

COMMENTS